Condo Insurance in and around Minneapolis

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Condo Sweet Condo Starts With State Farm

When considering different liability amounts, providers, and coverage options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condominium but also your personal belongings within, including cookware, furniture, videogame systems, and more.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

Everyone knows having condominium unitowners insurance is essential in case of a windstorm, hailstorm or tornado. Sufficient condo unitowners insurance can cover the cost of reconstruction, so you aren’t left with the bill for a home you can’t occupy. Another helpful thing about condo unitowners insurance is its ability to protect you in certain legal situations. If someone is injured at your residence, you could be required to pay for physical therapy or their medical bills. With enough condo coverage, you have liability protection in the event of a covered claim.

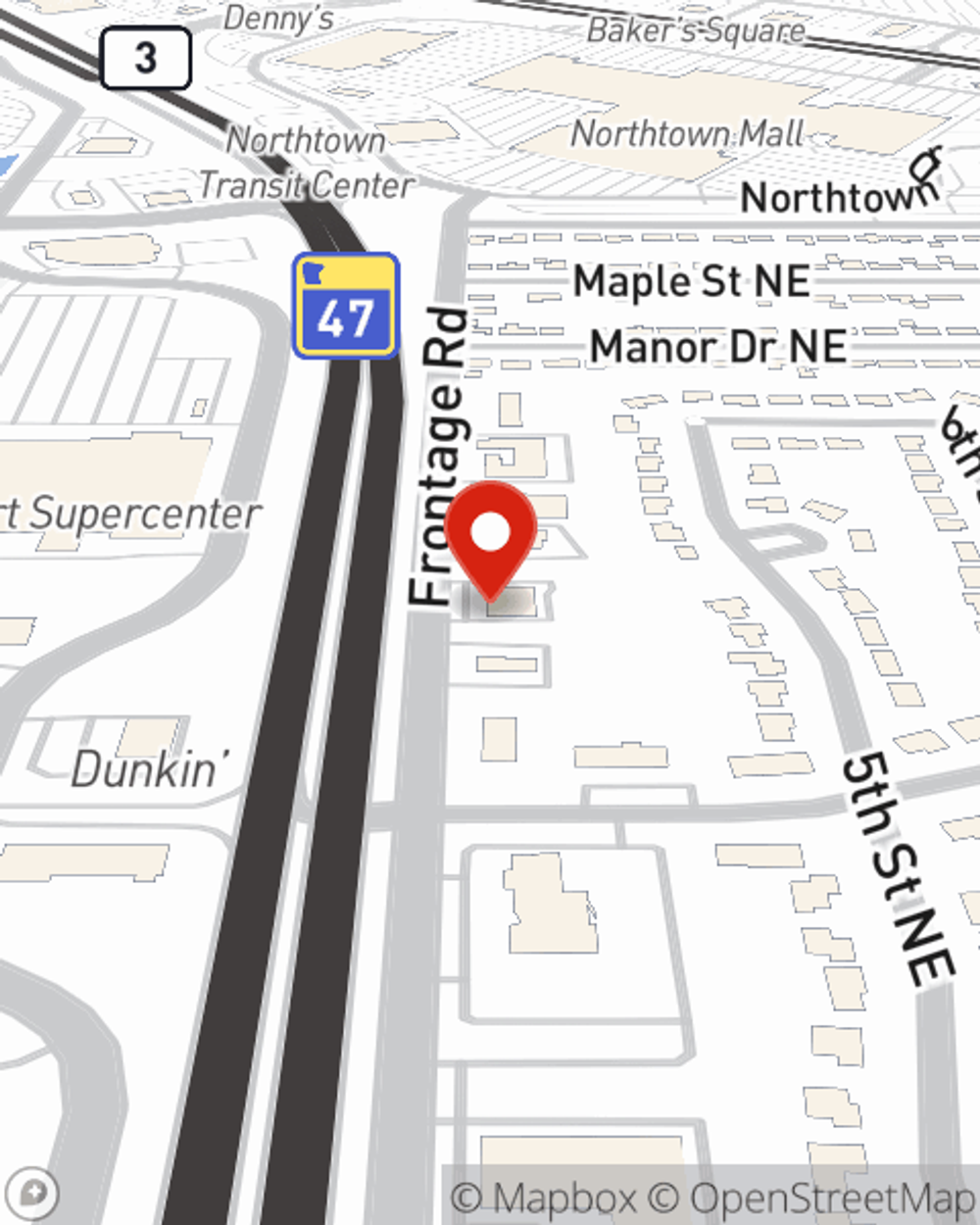

As a reliable provider of condo unitowners insurance in Minneapolis, MN, State Farm helps you keep your belongings protected. Call State Farm agent Seth Bork today for help with all your condominium unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Seth at (763) 780-2222 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.